Published Jan 21, 2025 • 5 min read

If you're a startup developing innovative fintech solutions or a financial institution looking to modernize legacy financial systems, understanding the fintech ecosystem is essential. This thriving landscape offers boundless opportunities for digital growth, driven by the collaboration between fintech companies, traditional institutions, regulators, and users. In this blog, we’ll explore the components that make up this ecosystem, the advantages it offers, and the emerging technologies shaping its future.

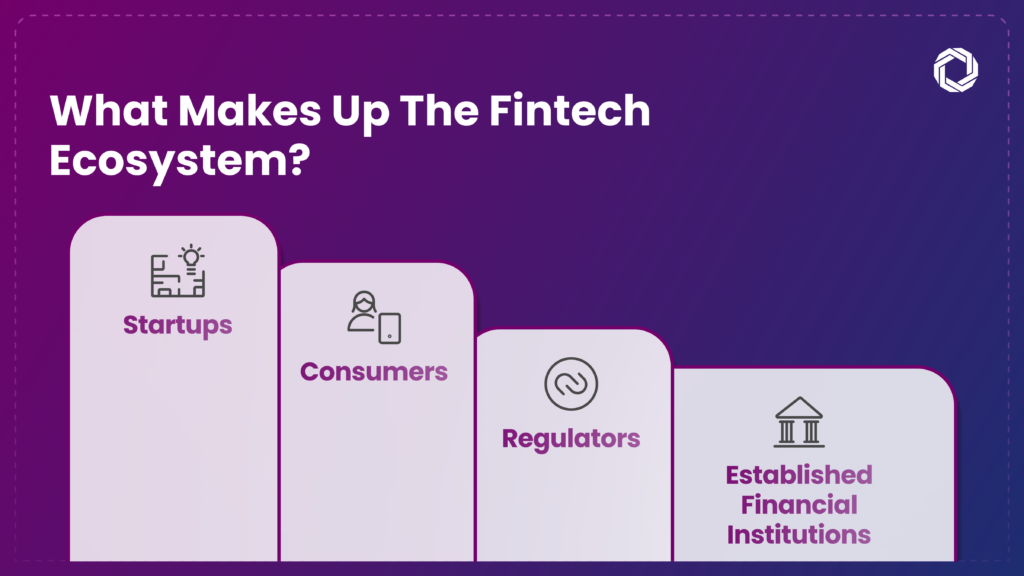

The fintech industry is built on the synergy between multiple stakeholders—each contributing to the ecosystem’s evolution. Together, they’re shaping the future of the financial services industry and revolutionizing how financial products and services are delivered.

Fintech startups serve as innovation engines in the ecosystem. Leveraging emerging technologies such as artificial intelligence (AI), they’re developing digital wallets, mobile payment platforms, and robo-advisors aimed at enhancing accessibility and delivering an improved customer experience. Many of these companies attract venture capital due to their disruptive potential and scalability.

Traditional players like banks, insurance companies, and asset management firms are adopting modern technologies and collaborating with fintech innovators. Their goal is to remain competitive while offering services such as AI-enabled advisory tools, automated lending systems, and custom cloud applications to meet evolving customer demands.

Regulatory bodies play a vital role in ensuring ethical practices, data security, and compliance within the ecosystem. By defining standards around privacy, fraud prevention, and digital identity management, they create a framework that supports sustainable fintech growth and protects consumers.

At the heart of it all are users—individuals and businesses—demanding faster, more personalized, and secure financial services. Their preferences are shaping the design of intuitive platforms that offer transparency, ease of access, and real-time financial interactions.

Engaging with the fintech ecosystem isn’t just about embracing technology—it’s about building resilient and inclusive financial products and services. Here’s why it’s essential:

Collaboration: Cross-sector partnerships lead to shared resources, innovation, and stronger service offerings.

Continuous Innovation: A fusion of tech evolution, user expectations, and regulatory updates fuels ongoing development.

Scalable Growth: Businesses embedded in the ecosystem benefit from network effects, venture capital funding, and technology adoption, positioning themselves for long-term success.

With the adoption of cloud tech services and AI-based analytics, fintech players can streamline operations, personalize services, and increase agility—delivering on modern consumer expectations.

Emerging technologies are redefining the financial services industry, leading to smarter, faster, and more secure systems. Let’s explore the trends driving transformation:

The shift to digital-first operations is accelerating. Custom application development for digital banking, AI-driven risk management tools, and cloud-native platforms are helping organizations improve efficiency, security, and customer engagement.

By integrating financial services into platforms like e-commerce, ride-sharing, or wellness apps, users can now access payments, credit, and insurance without visiting a traditional financial portal. This seamless experience is reshaping consumer expectations and loyalty.

Eco-conscious innovation is on the rise. Solutions like carbon tracking tools and green investment platforms are aligning fintech companies with sustainability goals, giving rise to ethical finance and purpose-driven business models.

Techlusion actively contributes to the advancement of the fintech industry by offering a comprehensive suite of technical solutions tailored to the evolving needs of startups and institutions alike. We help businesses innovate faster, maintain compliance, and deliver better user experiences.

Fintech Software Development: We develop robust digital platforms—from payment gateways to blockchain-based tools—that support modern financial systems.

Compliance & Automation: Techlusion’s intelligent automation solutions simplify complex compliance workflows while ensuring transparency and data integrity.

Custom Cloud Solutions: Our scalable cloud integration services support seamless deployment and integration into existing ecosystems, ideal for rapidly growing fintech companies.

AI-Driven Analytics: Using artificial intelligence (AI), we help financial firms unlock predictive insights, optimize decision-making, and deliver hyper-personalized customer experiences.

Whether you’re creating next-gen financial products and services or modernizing outdated systems, Techlusion offers the strategic and technical support you need to lead the digital finance revolution.

From custom application development to full-scale digital transformation, Techlusion partners with forward-thinking fintech leaders to accelerate growth and innovation. Whether you’re a rising startup or an enterprise financial institution, we’re here to help you future-proof your operations and redefine what’s possible in finance.

The Role of a Fintech Digital Marketing Agency in Driving Growth